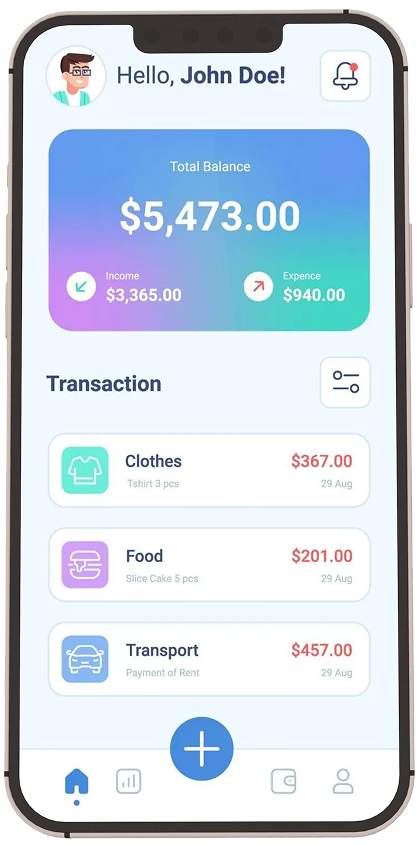

Spend smart, Save more, Invest wisely.

Budgvalor goes beyond basic budgeting. It's a modern financial and investment management system built to support your entire financial journey—from daily spending to long-term investing.

Create savings buckets for travel, emergencies, or your next big purchase

Build flexible monthly budgets that reflect your values and lifestyle.

Stay on top of your spending, savings, and investments—all in one place. Budgvalor gives you the clarity and control you need to manage your finances effortlessly, every day.

A new portfolio tool makes it easier to follow your financial growth.

Learn how to build your travel fund.

Track your spending, savings, and investments from a single, easy-to-use platform.

Set custom savings targets, monitor your progress visually, and celebrate milestones along the way.

Whether you're at home or on the go, your data stays up to date.

Budgvalor is packed with powerful tools to help you budget smarter, save faster, and invest with confidence—all from one beautifully simple app.

Create flexible budgets, categorize spending, and plan ahead without the stress.

View your portfolio at a glance, monitor performance.

Set specific targets for what matters most—travel, emergencies, or big purchases

Update your contact info without changing your QR code.

Take control of your spending, saving, and investing—all in one powerful app.

Get Started Today

Budgvalor is an all-in-one financial management app that helps you budget, save, and invest in one place. Track your spending, set savings goals, monitor your investment portfolio, and sync everything across your devices.

Yes! In your Budget or Goals screen, tap Share, enter the collaborator’s email address, and choose their permission level. Changes sync instantly across all linked devices for seamless teamwork.

Absolutely. You can access Budgvalor via the web, iOS, and Android apps. All your data syncs instantly so you can manage your finances anytime, anywhere.

You can create customized savings targets—like a vacation fund or emergency stash—and track your progress visually. Set deadlines, contribute manually or automatically, and celebrate when you hit your goals.

Yes. Our portfolio tracking feature lets you monitor investment performance over time, view gains/losses, and stay aligned with your financial goals—all in one place

Your privacy and security are our top priorities. We use bank-grade encryption and never share your data without your permission.